35+ Wealth simple income tax calculator

Simply enter the amount borrowed the loan term the stated APR how frequently you make payments. Before we begin I want to emphasize that your day job income should be only one source of income.

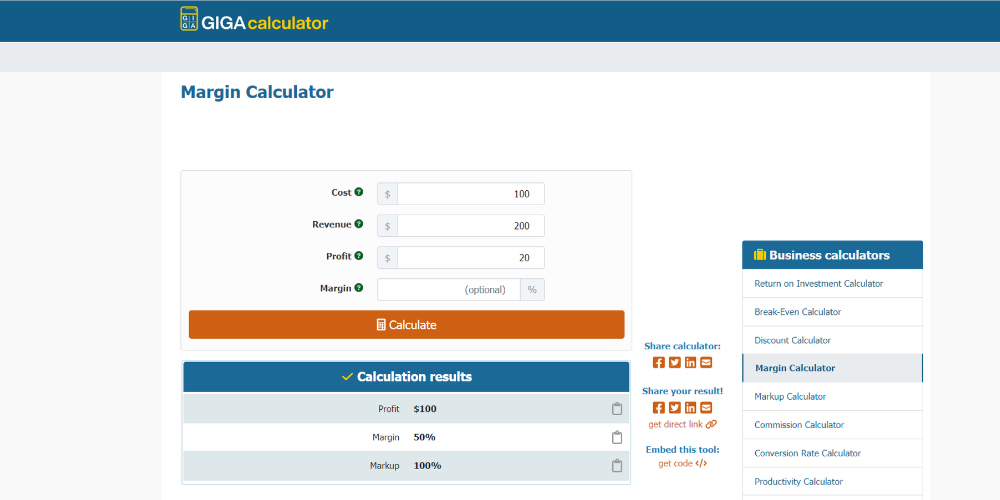

How To Calculate Profit Percentage 4 Profit Margin Calculator

For 2022 the rates are 10 12 22 24 32 35 and 37.

. As long as you have earned income up to the limit set by the IRS you can contribute to a Roth IRA. You must build multiple income streams if you want to eventually achieve. Receive 30 amount as lump sum on maturity of the investment and remaining 70 as a monthly income.

This tax ranges between 0 08. Another way to look at tax-equivalent yield is to look at an example comparing tax-equivalent yield across all marginal tax rates. For instance a person who makes 50000 a year would put away anywhere from 5000 to 7500 for that year.

We will quickly return your payment amount total interest expense total amount repaid the equivalent interest-only payments to show how much you would end up spending on interest if you did not pay down the balance. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. Income taxes in the United States are imposed by the federal government and most statesThe income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductionsIncome is broadly defined.

2022 Salary Paycheck Calculator Usage Instructions. You get a paycheck every couple of weeks and tax forms at. Income inequality metrics or income distribution metrics are used by social scientists to measure the distribution of income and economic inequality among the participants in a particular economy such as that of a specific country or of the world in general.

Disclosure of Exempt Income for Salary and Non-Salary Allowances. ICICI Bank offers fixed term deposit with monthly income option for resident individuals singly or jointly with flexible options. Income by race is an especially interesting topic during these times of social awareness and racial injustice.

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Is levied at progressive rates as per typical international income tax policies. Capital Gains Tax Calculator Real Estate 1031 Exchange.

We have prepared a small excel calculator which will be helpful in calculating the relief under 891 for arrears received in the Financial year 2021-22 and arrears relates maximum older up to the financial year 2005-06. Roughly speaking by saving 10 starting at age 25 a 1 million nest egg by the time of retirement is possible. Dont leave your retirement up to inaccurate software or calculators.

Also readfile 891 form online at Income Tax site otherwise claim will be rejected. While different theories may try to explain how income inequality comes about income inequality metrics simply. This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years.

Similarly this depends on the municipality of residence of the taxpayer. For salary account holders you need to make a disclosure of exempt income under Schedule S - Details of Income from Salary while filing income tax as per ITR-2. Access to your money.

A percentage below 35 is considered good. The total income tax due in Italy is then calculated by combining the three income tax amounts. Apply for a fixed deposit monthly income plan for a tenure of your choice.

Taxes on Ordinary Income. Supplementary Retirement Scheme SRS INSURANCE. WealthTraces retirement planning and financial planning software not only gives the most accurate projections but also allows you to track your investment holdings performance transactions and fees.

If your annuity is now worth 11000 youre younger than 59½ and you take your 11000 back you will owe ordinary income tax plus a 10 penalty on 1000 the part of the distribution that. You can withdraw your contributions at any time for any reason without taxes or penalties. How much of your income goes to CPF and its respective accounts.

Expense Ratio Total Operating Expense divided by Gross Operating Income GOI expressed as a percentage. What will be the tax impact of selling my investment property. A few simple steps used to be enough to control financial stress but COVID and student loan debt are forcing people to take new routes to financial wellness.

Tax Year 2022 Taxes Due April 2023. Any potential earnings grow tax-free and may not be taxed when you withdraw money in retirement. Individuals and corporations are directly taxable and estates and trusts may be taxable on.

Find out the latest contribution and allocation rates. Additionally both formulas tell the investor that the tax-exempt bond has a higher tax-equivalent yield. Early Critical Illness Insurance.

Comprehensive retirement planning software. Or over 647850 for married couples filing jointly 35 for single taxpayer incomes 215951 to 539900 or. Let us breakdown income by race based on the latest US.

Understanding your salary seems simple. You can declare exempt income while filing for income tax every financial year. Fixed Deposit Monthly Income Scheme.

If you have your paycheck in hand and do not know what the income tax rate is you can enter zero to convert a paycheck to other pay periods without estimating the impact of income taxes.

Non Profit Monthly Financial Report Template 8 Templates Example Templates Example Statement Template Financial Statement Financial Position

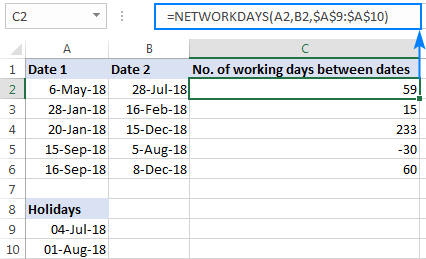

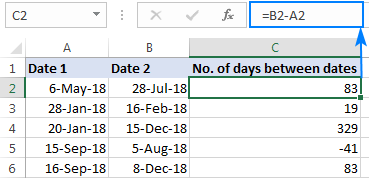

Calculate Number Of Days Between Two Dates In Excel

Calculate Number Of Days Between Two Dates In Excel

Take Your Budget To The Next Level With Mystery Money Man S 5 Day Freeze Budgeting Spending Freeze Budgeting Money

How To Calculate Profit Percentage 4 Profit Margin Calculator

Amazon Com How To Draw Clothing For Manga Learn To Draw Amazing Outfits And Creative Costumes For Manga And Anime 35 Outfits Side By Side With Modeled Photos 9780760376980 Date Naoto Books

Download Financial Plan Template 01 Financial Plan Template Financial Planning Business Plan Outline

Estate Planning Worksheet Template New 95 Estate Planning Worksheet Template Estate Pla Personal Financial Statement Statement Template Financial Plan Template

Sample Financial Statement Analysis Example Financial Statement Analysis Statement Template Financial Statement

How To Calculate Margin Margin Calculators Geekflare

Rental Property Spreadsheet Template For 25 Properties Business Property Management Marketing Rental Property Management Rental Agreement Templates

Monroe Ultimatexb 12 Digit Ikt Desk Print Calculator Black Walmart Com In 2022 Calculators Prints Colorful Prints

Download Profit And Loss Statement Template 37 Profit And Loss Statement Statement Template Profit

How To Calculate Margin Margin Calculators Geekflare

Profit And Loss Statement Template Goods Services Excel Profit And Loss Statement Statement Template Personal Financial Statement

How To Calculate Profit Percentage 4 Profit Margin Calculator

How To Calculate Margin Margin Calculators Geekflare